In November 2015, China’s R134a price continued

declining. CCM predicts that the price will stay stably low in 2016, pressured

by the severe overcapacity.

In November 2015, China’s 1,1,1,2-tetrafluoroethane (R134a) market stayed flat.

Manufacturers competed to deliver goods, which further pulled down the price

slightly: ex-works price down by 2.33% from USD2,875/t (RMB18,157/t) in October

to USD2,808/t (RMB17,964/t).

In late November, however, the price stopped falling and tended to be stable,

since most manufacturers’ inventory pressure was eased - they maintained low

operating rates and delivered ordered goods.

In December, the overall market is stable. Downstream clients procure R134a

based on demand. In addition, the price of trichloro ethylene (raw material)

keeps stable. It is expected that the price will remain stable this month.

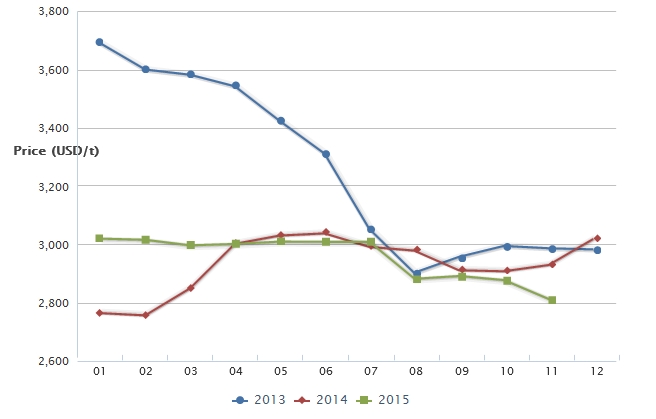

Ex-works price of 1,1,1,2-tetrafluoroethane in China, 2013–2014 &

January–November 2015

Source: CCM

CCM believes that in 2016, the R134a price will stay stably low and will not

rise significantly, except the possible upturn in Q2 (peak period). This is

mainly because the overall R134a industry is pressured by severe overcapacity.

Certainly it will not further decrease, either, as the price has already come

near to the cost line.

In view of the price trend in 2015, overcapacity played a vital role in

dragging down the price.

In H1, the domestic R134a price made a recovery over the same period of 2014.

Specifically, during January-June, the average ex-works price was up by 3.51%

YoY to USD3,009/t (RMB19,249/t).

Specifically:

1. At the end of 2014, the US failed in the anti-dumping and anti-subsidy

investigation on China-made R134a. This propelled the domestic R134a export to

take a favourable turn and further to increase the overall shipments.

2. During the Spring Festival, leading R134a manufacturers including Zhejiang

Sanmei Chemical Industry Co., Ltd., Sinochem Lantian Co., Ltd. and Shandong

Dongyue Chemical Co., Ltd. suspended production for maintenance, and only

Zhejiang Juhua Co., Ltd. ran at low operating rate. This directly led to the

tight supply afterwards.

3. The peak period in Q2 contributed to the increasing demand.

In H2, especially from August, both the exports and the domestic demand

decreased. However, since the manufacturers, attracted by the high profit margin

in early period, up-regulated the operating rates or restarted production, the

supply then outstripped the demand very quickly. In order to facilitate the

transactions, manufacturers were involved in price competition. Consequently,

the price declined and hit the 2013-2015 historical low in November. Most

manufacturers were only able to sell out R134a at cost prices.

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc. More about CCM, please visit www.cnchemicals.com.

China Refrigeration is one of the leading exhibitions in the world for refrigeration, air-conditioning, heating and ventilation, frozen food processing, packaging and storage. It will take place on 3 days from Thursday, 07. April to Saturday, 09. April 2016 in Beijing.

We will attend China Refrigeration Beijing in the coming month. If you would like to meet us for consultancy in China Refrigeration Beijing, please get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.